AITA for using my kids college accounts for my retirement?

Oh, the never-ending tightrope walk of parenting! Today, we're diving into a story that cuts right to the core of parental sacrifice, financial planning, and the incredibly difficult choices families sometimes face. It's a tale that will undoubtedly ignite a firestorm of opinions, as it pits a parent's desperate need against their children's future aspirations.

This isn't just about money; it's about trust, expectation, and the unwritten contract between parents and their kids. When life throws unexpected curveballs, how far are you justified in rerouting funds that were once earmarked for a specific, vital purpose? Our OP found themselves in an unenviable position, and their solution has rocked their family to its core. Let's dig in.

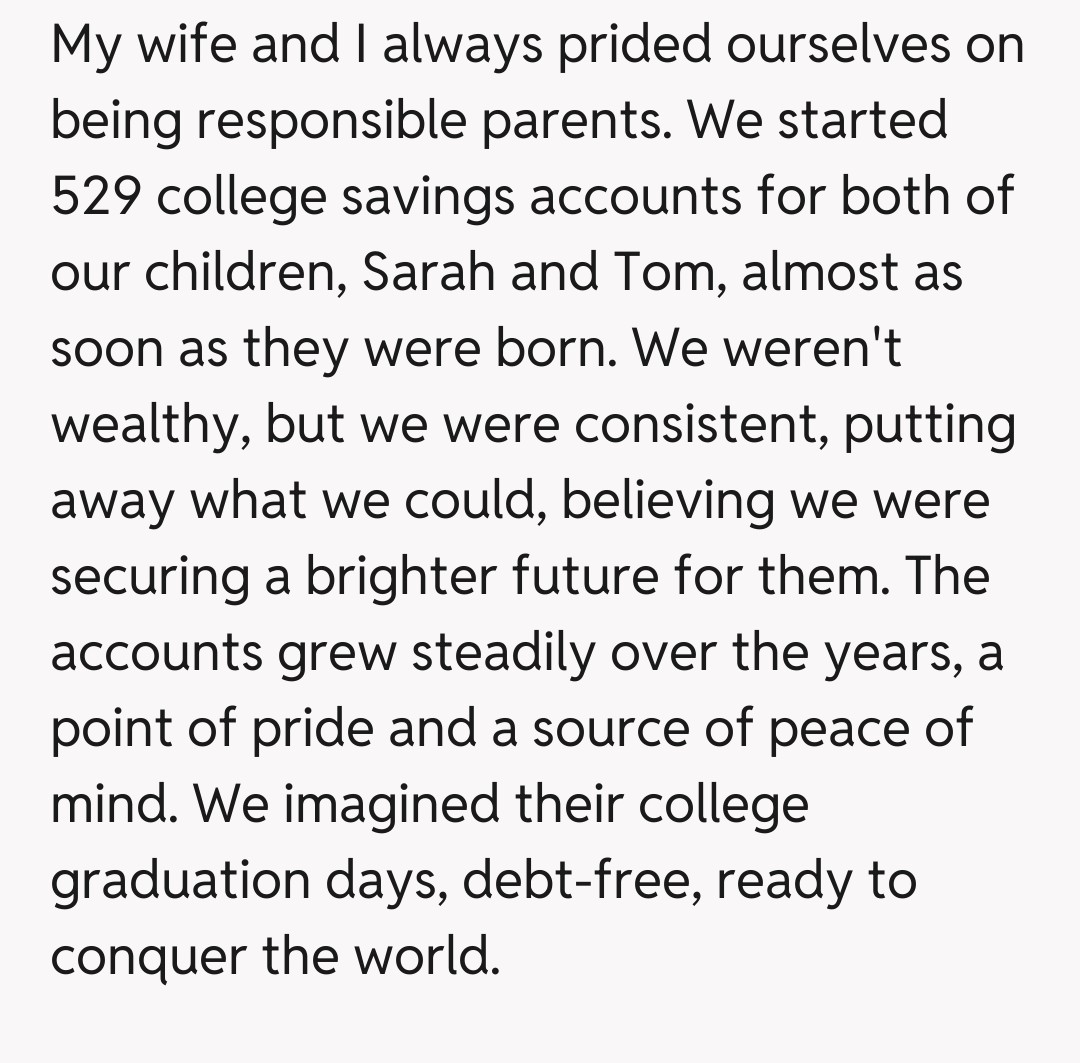

"AITA for using my kids college accounts for my retirement?"

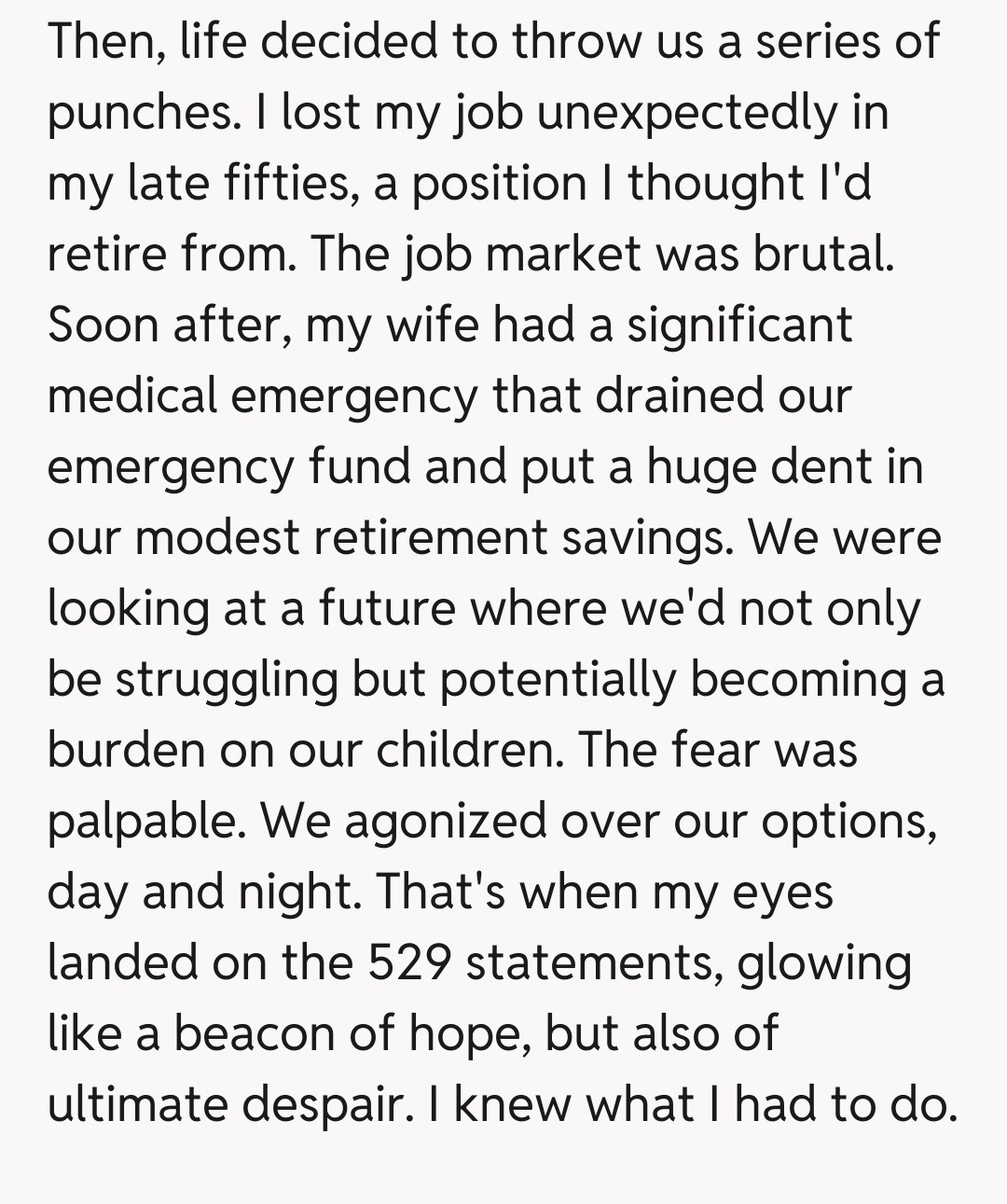

This story plunges us into the heart of a truly heartbreaking dilemma, where no choice feels right and everyone stands to lose. On one hand, we have parents facing an unforeseen financial catastrophe – a job loss in late career and debilitating medical expenses. The pressure to secure one's own future, to avoid becoming a financial burden on adult children, is immense and a very real fear for many.

However, the ethical weight of using funds specifically designated and promised for a child's college education cannot be overstated. These 529 accounts weren't just bank balances; they were symbols of a parental commitment, a foundation for the children's aspirations, and a deeply ingrained promise. To unilaterally withdraw from them, especially without prior, transparent discussion, constitutes a significant breach of trust.

From the children's perspective, this act would undoubtedly feel like a profound betrayal. They've built their educational plans and future expectations around these savings. Now, they're faced with the sudden reality of increased debt, altered plans, and the emotional sting of having their future undermined by the very people who vowed to protect it. Their anger and feelings of abandonment are entirely valid.

Ultimately, this situation highlights the brutal reality that life doesn't always offer easy choices. While the parents' motivations stemmed from a place of desperation to secure their own future, the impact on their children's financial stability and their relationship is severe. It's a tragic confluence of circumstances where a parent's survival instinct clashes directly with their long-standing commitment to their children's education.

College Funds or Retirement Funds: Where Do You Draw the Line?

The comments section for this story, as expected, was a whirlwind of emotions and strong opinions. Many commenters empathized deeply with OP's desperate situation, acknowledging the crushing weight of unexpected job loss and medical debt. They highlighted that parents cannot pour from an empty cup, suggesting that ensuring the parents' stability might, in a twisted way, prevent them from becoming an even greater burden later on.

However, the overwhelming sentiment leaned towards YTA, or at least ESH (Everyone Sucks Here). Commenters consistently brought up the broken trust and the specific designation of the funds. Many argued that college funds are a promise, and while emergencies happen, the lack of transparency before the withdrawal and the impact on the children's future prospects were unforgivable. Suggestions of other options, like a reverse mortgage or selling assets, were also prevalent.

This AITA story serves as a stark reminder of the complexities of life and the painful financial decisions families sometimes confront. There's no easy answer when a parent's desperate need clashes with their children's designated future. While many feel the OP betrayed their children's trust, others recognize the immense pressure to survive. This story underscores the critical importance of transparent communication, comprehensive financial planning for all life stages, and exploring every possible alternative before making choices that have such profound and lasting impacts on family relationships.