AITA for putting my inheritance into a trust because I don’t trust my siblings not to blow it all?

Inheritance disputes are as old as time, often bringing out the best and worst in families. When a loved one passes, their legacy isn't just about money; it's about the emotional weight, the memories, and the future they envisioned for their heirs. But what happens when you believe some of those heirs aren't equipped to handle a significant financial windfall responsibly? It's a delicate situation that can quickly turn hostile.

Today's AITA post dives deep into this very dilemma. Our OP, concerned about their siblings' financial history, decided to take proactive measures with their own share of a substantial inheritance. The question isn't just about legal rights, but about familial obligation, perceived betrayal, and the difficult line between caring for loved ones and controlling their choices. Let's unpack this thorny issue together.

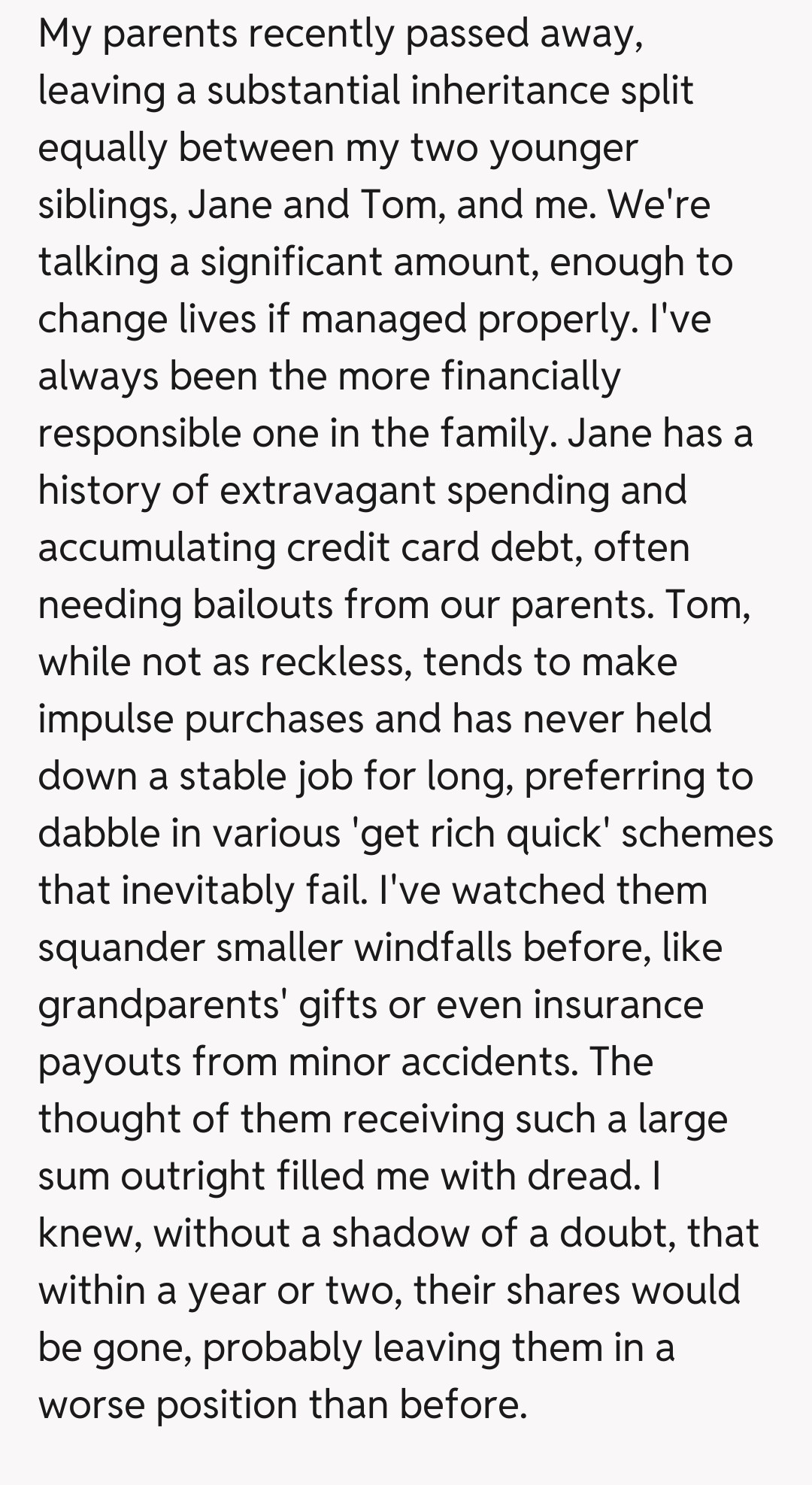

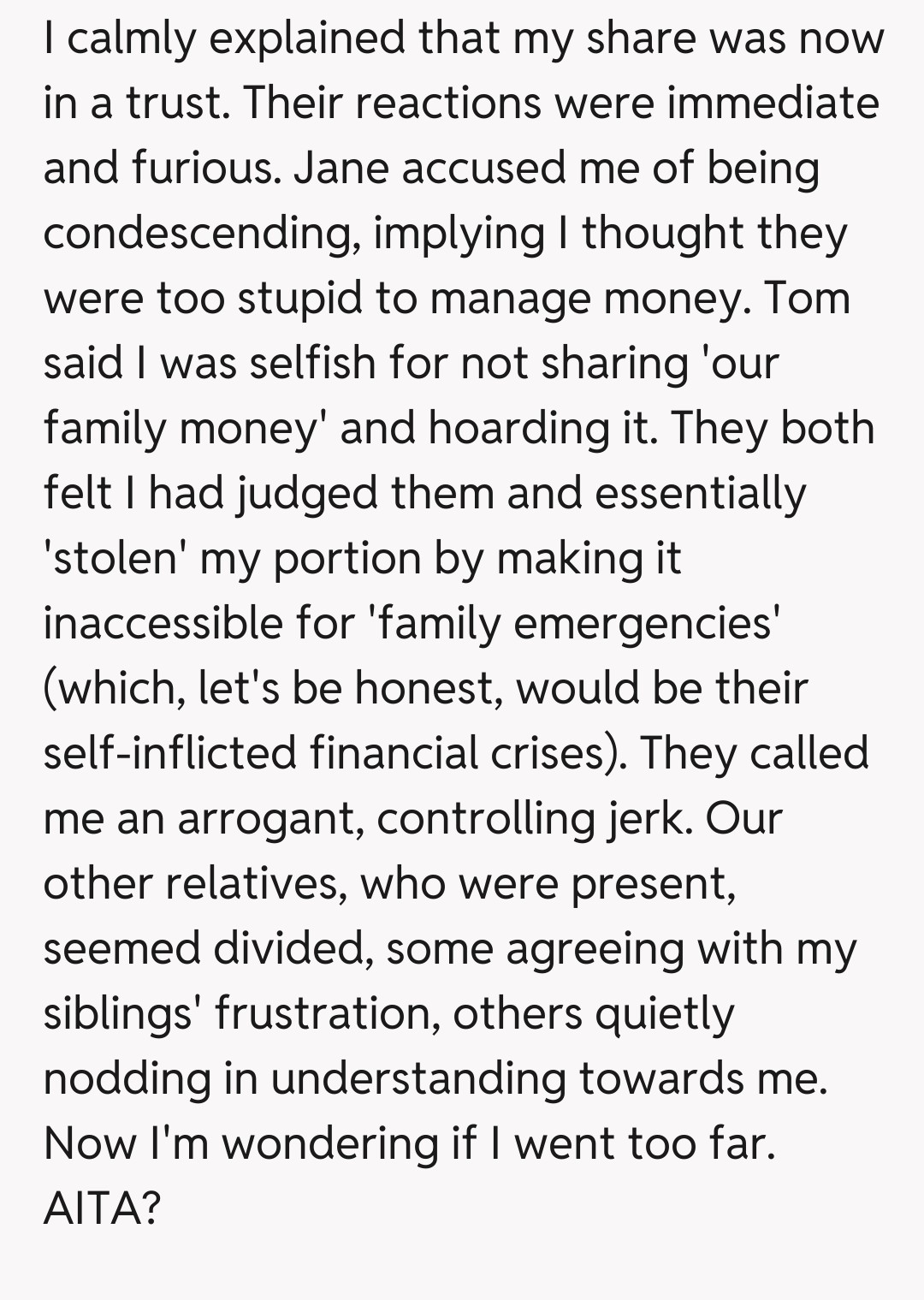

"AITA for putting my inheritance into a trust because I don't trust my siblings not to blow it all?"

This situation presents a classic clash between individual financial prudence and familial expectations. It’s entirely understandable why the original poster would be concerned about their siblings' financial habits. A history of reckless spending and failed ventures isn't just an inconvenience; it can lead to significant distress and, potentially, repeated requests for financial assistance from more stable family members. OP's desire to safeguard their own future, and implicitly, to avoid becoming the default bailout fund, is a valid one.

Legally and ethically, an inheritance, once distributed, becomes the personal property of the beneficiary. Therefore, OP has every right to manage their share as they see fit. Establishing a trust for personal financial management is a common and responsible strategy. It protects assets, provides structure, and can offer long-term security. The fact that it also serves as a barrier against potential requests from financially unstable relatives is a practical, if perhaps unstated, benefit.

However, the emotional impact on the siblings is also palpable. They likely feel judged and belittled by OP's actions. The perception that OP believes them incapable of handling their own money can be deeply hurtful and can easily be interpreted as a lack of trust or even contempt. This feeling of being 'managed' or controlled, even indirectly, within a family dynamic can lead to significant resentment and a sense of betrayal, especially when substantial sums are involved.

The core issue might not be the trust itself, but the communication around it. While OP didn't explicitly involve the siblings in the decision, the way it was disclosed clearly caused a rift. Perhaps a more proactive conversation about personal financial planning, without directly mentioning their habits, could have softened the blow. Regardless, the current outcome highlights how financial decisions, even individual ones, can profoundly affect family relationships, creating deep divisions that are hard to mend.

The Family Fortune Fiasco: Did OP Cross the Line, or Just Draw a Smart Boundary?

The comment section is buzzing, and it's clear the vast majority of you are firmly on OP's side. Many are pointing out the fundamental right to manage one's own inheritance without external interference, particularly when there's a documented history of financial irresponsibility from the siblings. Phrases like 'NTA, protect your peace and your money' and 'It's YOUR money, not theirs' are common refrains, emphasizing individual autonomy over perceived family obligations.

However, there's a minority view, or at least a more nuanced perspective, acknowledging the family dynamic. Some commenters suggest that while OP's actions are justifiable, the method of communication could have been handled more delicately to preserve family ties. A few even highlight that siblings' reactions, while perhaps overblown, stem from feeling judged, which is a difficult emotion to navigate. Still, the overwhelming sentiment supports OP's decision as a logical and self-preserving move.

Ultimately, this AITA post underscores the complex intersection of money, family, and personal responsibility. While OP's actions were financially sound and legally permissible, the emotional fallout highlights the delicate balance required when dealing with loved ones. It's a stark reminder that even the most logical decisions can have profound relational consequences. What's clear is that boundaries, especially financial ones, are crucial, but how those boundaries are communicated can make all the difference in preserving, or irrevocably damaging, family bonds.