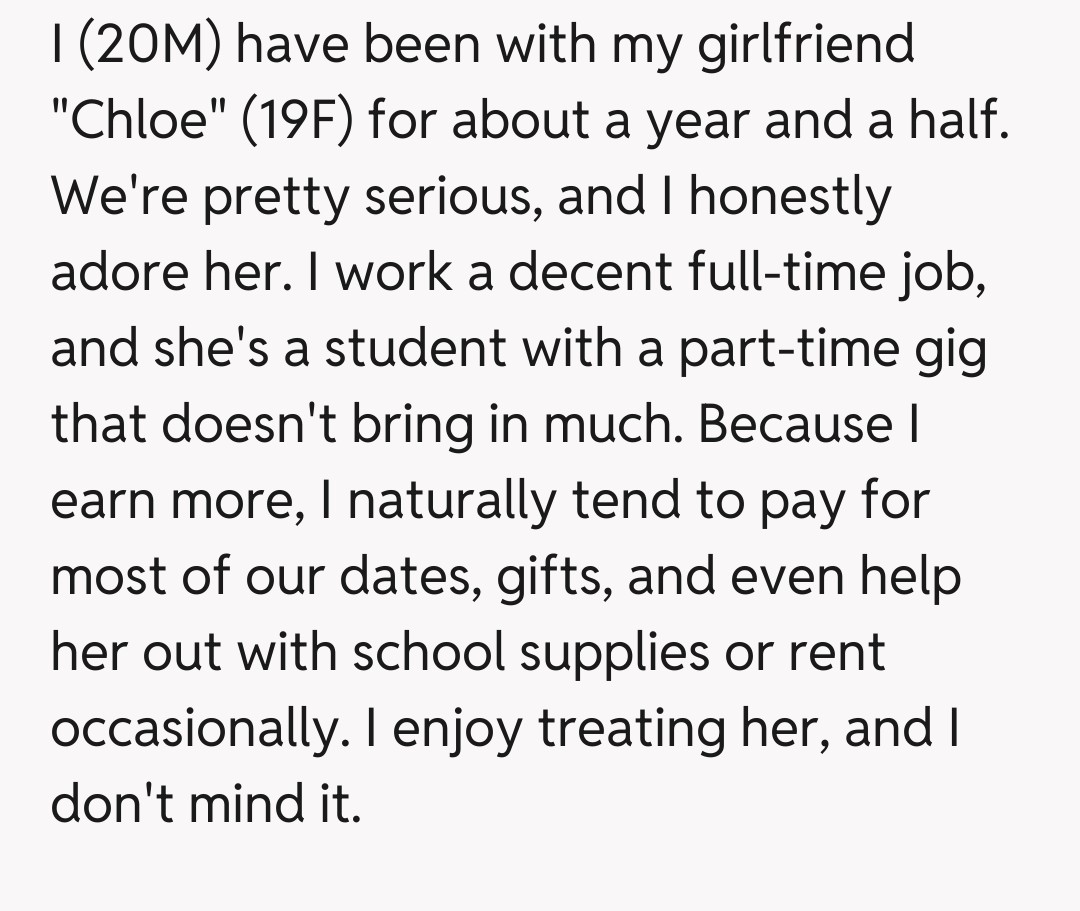

I (20M) don’t want my gf (19F) to hold onto my money. I spend most of my money on her, but she wants to act as a bank and keep 100% of my money.

Welcome back, AITA readers! Today we're diving into a financially tangled tale involving a young couple. Our OP, a 20-year-old, finds himself in a sticky situation with his 19-year-old girlfriend. It's a classic case of money matters getting between lovebirds, but with a twist that might just raise a few eyebrows. Is he being unreasonable for wanting control of his own earnings, or is his girlfriend crossing a line?

Financial dynamics in relationships can be incredibly complex, especially when you're young and still figuring things out. Trust, independence, and shared goals often come into play. This story highlights how quickly good intentions can morph into something controlling. Let's unpack the details of this peculiar arrangement and see if our OP is truly the "asshole" for wanting his cash back.

"I (20M) don't want my gf (19F) to hold onto my money. I spend most of my money on her, but she wants to act as a bank and keep 100% of my money."

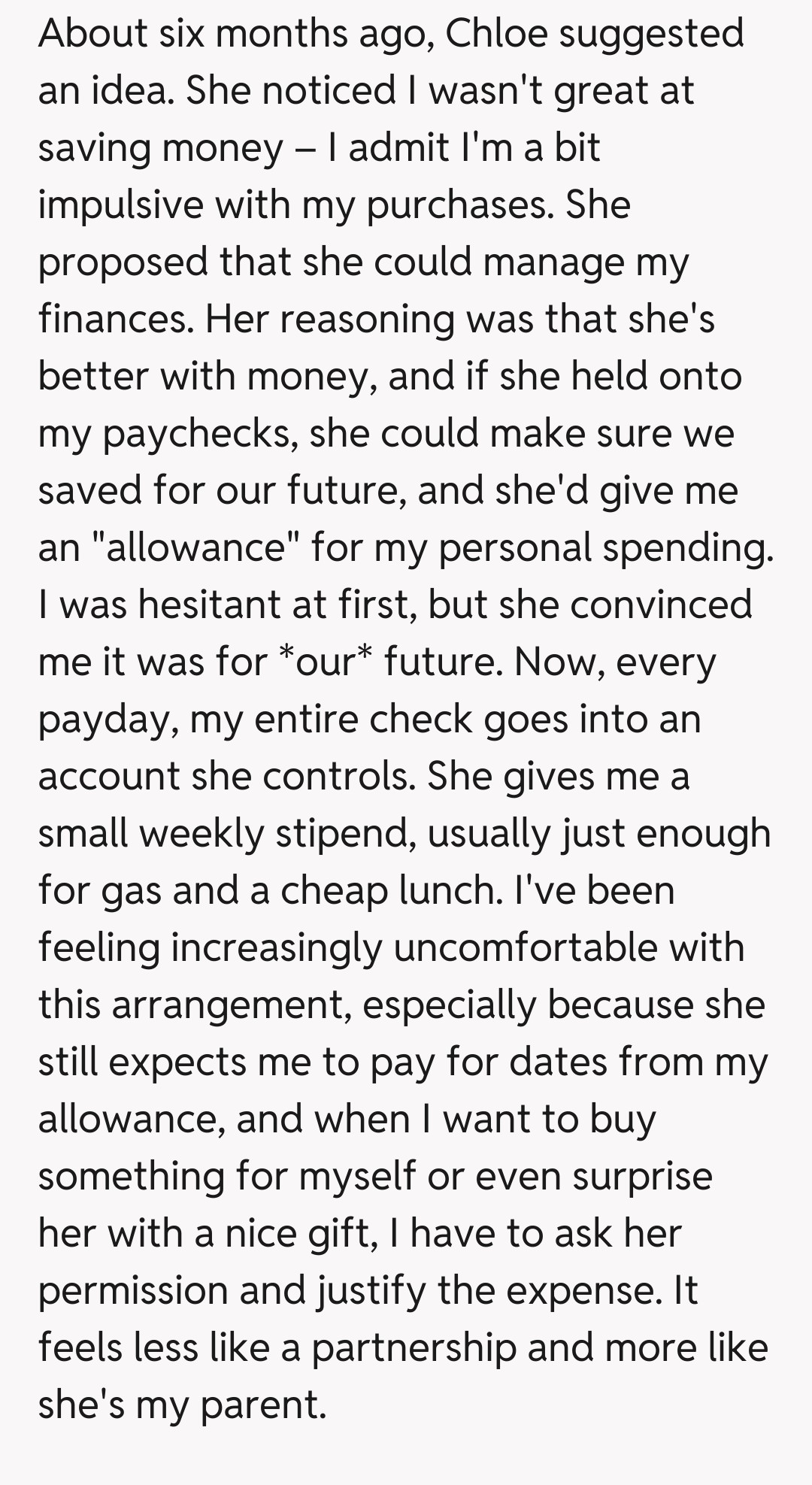

This situation presents a classic dilemma about financial autonomy versus perceived shared goals within a relationship. On one hand, the girlfriend’s initial intention to help with saving, especially if the OP admits to being an impulsive spender, could be seen as a supportive gesture. It’s not uncommon for partners to help each other manage weaknesses, and financial management is a frequent point of contention.

However, the critical element here is the *degree* of control and the *lack* of mutual agreement on its ongoing implementation. The girlfriend has taken 100% control of the OP's income, dictating an "allowance" and requiring justifications for spending. This shifts the dynamic from a supportive partnership to one resembling a parent-child relationship, which is highly problematic for an adult.

Furthermore, the girlfriend's reaction to the OP's attempt to regain control is a significant red flag. Accusations of distrust, selfishness, and threatening the relationship when faced with a reasonable request for autonomy indicate a deeper issue than just financial management. Healthy relationships thrive on open communication and respect for individual boundaries, even concerning shared finances.

While a desire for a secure "future" is commendable, it should not come at the cost of one partner's complete financial independence. Joint accounts or shared budgeting tools are common, but one partner unilaterally controlling all of the other's income without true consent and with punitive measures for dissent, crosses into controlling behavior rather than healthy financial partnership.

The Internet Weighs In: Is She Your GF or Your Financial Overlord?

The comments section on this one was, as expected, a fiery debate! A vast majority of users sided with OP, expressing serious concerns about the girlfriend's controlling behavior. Many pointed out the clear red flags in her taking 100% of his income and demanding justification for his spending. The consensus was that while saving is good, losing all financial autonomy is a huge problem.

A few users, however, tried to see it from the girlfriend's perspective, suggesting she might genuinely be trying to help him save, given his admitted impulsiveness. They argued that if "our future" is the goal, then perhaps drastic measures were needed. Yet, even these users generally agreed that her refusal to compromise and her emotional manipulation were unacceptable and ultimately detrimental.

This AITA post serves as a stark reminder that while financial transparency and shared goals are vital in relationships, complete control by one partner over another's earnings can quickly become problematic. The line between supportive help and controlling behavior is often thin, and in this case, it appears to have been unequivocally crossed. It's crucial for both partners to maintain autonomy and respect boundaries, especially concerning personal finances. Hopefully, OP finds a way to navigate this tricky situation and reclaim his financial independence, while also fostering a healthier, more balanced relationship dynamic.